The Idea: Microsoft CEO, Satya Nadella, recently stated: “Despite all this rapid change in the computing industry, we are still at the beginning of the digital revolution.” The revolution has only just begun. We all look for certainty in an increasingly uncertain world and we over protect ourselves from the risk of loss. This inherent response can lead us to make bad decisions. Psychologists Daniel Kahneman and Amos Tversky’s Prospect Theory research validates this: we often choose to embrace a sure thing (that is less valuable) than something riskier that could offer a huge advantage. It’s how we are wired.

So how do we confidently navigate an unpredictable world?

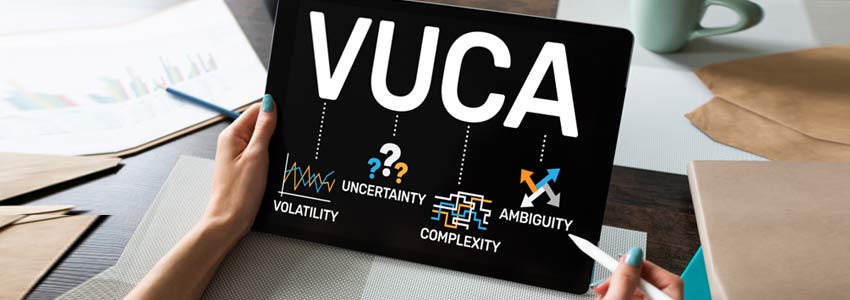

I was recently reminded of the VUCA theory by Kantar’s Bryan Gildenberg on one of his most recent podcasts. VUCA is an acronym developed in the wake of the Cold War to describe the complexities of a post-war world. We live in a culture of increasing Volatility, Uncertainty, Complexity, and Ambiguity. I see this personally with my clients who are confronting hyper-competition in an anxiety ridden business environment.

During coaching sessions, I try to help leaders recognize business threats through self-awareness of personal behaviors (or mindsets) that hinders performance. Americans are more anxious today than they were a year ago, with 39 percent of people reporting they consistently feel more anxious. Take a moment to quickly assess your competitive threats:

- Volatility - Are you broadly preparing for change while structured for agility and speed?

- Uncertainty - Are you investing in advisors and expanding your contextual knowledge?

- Complexity - Do you have diverse specialists in your corner helping you see your blind spots and interconnectedness of your challenges?

- Ambiguity – Have you embraced a “test and learn” mindset to illuminate next steps?

VUCA should create stress, but it is the catalyst for new growth. The sooner we get comfortable, the sooner we are objective about the challenges ahead.

We love what we know.

We tend to hold on to our most familiar ideas and relationships, even if there are better alternatives. NN, the European financial services company, discovered that we overweigh options that appear safe, even when they are not. The research showed that we normally invest in smaller “sure things” rather than investing where we should.

We close doors in fear of losing what we know. What discussions should you have with your team this week that feel uncomfortable?

We also love what is simple.

Between three options, we normally choose the simplest. The Isolation Effect predicts that when multiple similar objects are present, people tend to choose the option that differs from the rest (the simplest). Our internal response is to distance ourselves from anything that creates discomfort or pain. And for most of us “complexity” equals “pain.” We run from it – it’s instinctual. We do this even when it is the wrong choice.

The VUCA paradigm shines a light on the inevitable: things will continue to change. Asking the above questions force us to objectively assess how we are handling complexity and the unknown. We are guided by our unconscious minds which detest volatility, uncertainty, complexity and ambiguity.

I am reminding myself daily to prepare for change. Truth is rarely simple or certain. Are you playing tight or embracing a changing world?